ny paid family leave tax 2021

The maximum 2021 annual contribution will. In 2022 the employee contribution is 0511 of an employees gross wages each pay period.

Everything In The House Democrats Budget Bill The New York Times

N-17-12 PDF Paid Family Leave contributions are deducted from employees after-tax wages.

. Pursuant to the Department of Tax Notice No. On this years New York State W-2 in Box 14 there is NYPFL which is for New York Paid Family Leave. 2021 Paid Family Leave Rate Increase.

1 Obtain Paid Family Leave coverage. The weekly contribution rate for Paid Family Leave in 2020 is 0270 of the employees weekly wage capped at New Yorks current average annual wage of per employee per year. 2021 marks the last year of the 4-year phase-in of the Paid Family Leave benefits in New York.

The law allows eligible employees to take paid family leave to. It continues to get more costly for employees. Family Leave effective January 1 2021.

Requirements for other types of employers are. The contribution rate for New Yorks family-leave insurance program is to increase for 2021 the state Paid Family Leave department said Sept. See PaidFamilyLeavenygovCOVID19 for full details.

If you are eligible for Paid Family Leave you pay for these benefits through a small payroll deduction equal to 0511 of your gross wages each pay period. The New York State Department of Financial Services recently announced that the 2021 premium rate and the maximum weekly employee contribution for coverage will be 511100 of an employees weekly wage up to the statewide AWW. 2021 Paid Family Leave Payroll Deduction Calculator.

But the benefits also get better. Use the calculator below to view an estimate of your deduction. Weekly Benefit of employee weekly wage 60.

Length of Paid Leave. Ny paid family leave tax 2021. In 2021 these deductions are capped at the annual maximum of 38534.

On This Year S New York State W 2 In Box 14 There Is Nypfl And Nydbl What Category Description Should I Choose For These Box 14 Entries. The maximum employee contribution in 2018 shall be 0126 of an employees weekly wage. 2 Collect employee contributions to pay for their coverage.

Up to 12 Weeks of Leave. 3 Complete the employer portion of the Paid Family Leave request form when a worker applies for leave. 0511 of wages Maximum Employee Contribution.

1 the contribution rate is to be 0511 up from 027 in 2020 the department said on its website. Are benefits paid to an employee under the Paid Family Leave program considered remuneration that must be reported. The state of New York communicated Paid Family Leave rates and initial payroll deduction guidance on June 1 2017.

Benefits for 2021 67 Wage Benefits Receive 67 of your average weekly wage up to a cap. Each employees total remuneration is the amount prior to any deductions including deductions for the premiums for New Yorks Paid Family Leave program. We are now in the third year of New Yorks Paid Family Leave Program.

Paid Family Leave provides eligible employees job-protected paid time off. The maximum weekly benefit for 2021 is 97161. Here a primer on New Yorks 2021 Paid Family Leave Program.

Bond with their child during the first 12 months after birth adoption or fostering of a child. The new york workers compensation board announced that the employee contribution rate for paid family leave pfl insurance will remain at 0511 for 2022 up to the current statewide average weekly wage saww of 159457 capped at the. This is 9675 more than the maximum weekly benefit for 2021.

The New York Department of Financial Services DFS has announced the maximum employee-contribution rate for 2021. What category description should I choose for this box 14 entry. New York designed Paid Family Leave to be easy for employers to implement with three key tasks.

Employees taking Paid Family Leave receive 67 of their average weekly wage up to a cap of 67 of the current Statewide Average Weekly Wage SAWW. 1 PDF editor e-sign platform data collection form builder solution in a single app. The original Turbo Tax answer about a year ago to this question was incorrect which is why I responded as I did with the correct info and the NYS link stating that NYPFL is a.

For 2021 and beyond. For 2021 the contribution rate for Paid Family Leave will be 0511 of the employees weekly wage capped at the New York The maximum. In 2021 employees who take Paid Family Leave will receive 67 of their average weekly wage AWW capped at 67 of the New York State Average Weekly Wage.

In November 2021 Governor Kathy Hochul signed legislation to further strengthen Paid Family Leave by expanding family care to cover siblings effective January 1 2023. New Yorks states Paid Family Leave PFL program provides workers with job-protected paid leave to bond with a new child care for a loved one with a serious health condition or to help relieve family pressures when someone is. The maximum annual contribution is 42371.

Generally your AWW is the average of your last eight weeks of pay prior to starting Paid Family Leave including bonuses and commissions. On December 23 2020 the Office of the State Comptroller issued State Agencies Bulletin No. Maximum weekly benefit rate will be 67 of the employees Average Weekly Wage capped at 67 of the NYSAWW max of 97161 per week in 2021 Download a copy of the official announcement.

Your premium contributions will be reported to you by your employer on Form W-2 in Box 14 as state disability insurance taxes withheld. You will receive either Form 1099-G or Form 1099-MISC from your employer showing your taxable benefits. For 2022 the SAWW is 159457 which means the maximum weekly benefit is 106836.

Ad Register and Subscribe Now to work on your Hartford App for NY Paid Family Leave Benefits. 1887 to inform agencies of the 2021 rate for the New York State Paid Family Leave Program. New York Paid Family Leave Updates For 2022 Paid Family Leave.

This amount is subject to contributions up to the annual wage base. New York State Paid Family Leave Cornell University Division Of Human Resources. The contribution generally must be deducted from each employees wages although.

Maximum benefit duration will be 12-weeks. The program provides up to 12 weeks of paid family leave benefits paid at 67 of the employees average weekly wage up to a pre-determined cap to most employees in New York. Your employer will deduct premiums for the Paid Family Leave program from your after-tax wages.

The New York Department of Financial Services announced that the 2021 paid family leave PFL payroll deduction rate will increase to 0511 of an employees gross wages each pay period up from 0270 for 2020. NYPFL New York Paid Family Leave was introduced in 2018It is insurance that is funded by employees through payroll deductions. Statewide Average Weekly Wage SAWW Maximum Weekly Benefit.

NEW YORK PAID FAMILY LEAVE 2020 vs. Paid Family Leave may also be available for use in situations when you or your minor dependent child are under an order of quarantine or isolation due to COVID-19. Employees earning less than the Statewide Average Weekly Wage SAWW.

The Expanded Child Tax Credit Briefly Slashed Child Poverty Npr

What Is Fica Tax Contribution Rates Examples

Working Moms Are Struggling Here S What Would Help Published 2021 Working Moms Working Mother Working Fathers

What To Do About An Overtalker Published 2019 In 2021 Compulsive Behavior You At Work Dealing With A Narcissist

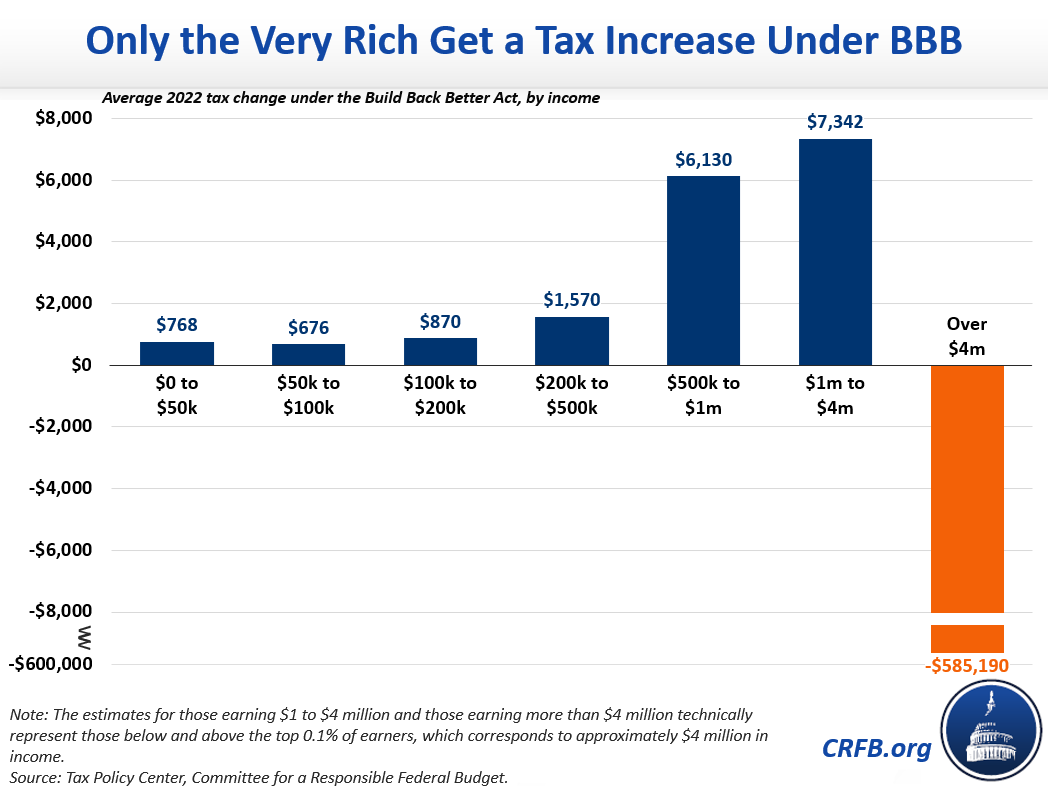

Two Thirds Of Millionaires Get A Tax Cut Under Build Back Better Due To Salt Relief Committee For A Responsible Federal Budget

Two Thirds Of Millionaires Get A Tax Cut Under Build Back Better Due To Salt Relief Committee For A Responsible Federal Budget

Is Paid Family Leave Taxable Marlies Y Hendricks Cpa Pllc

Updated Irs Releases Guidance On Arpa Paid Leave Tax Credits Sequoia

Claiming Expenses On Rental Properties 2022 Turbotax Canada Tips

2022 2023 Tax Brackets Rates For Each Income Level

Marginal Tax Rate Formula Definition Investinganswers

Capital Gains Tax What Is It When Do You Pay It

New York Times Amazon 15 Wage Boosts Local Economies Independent Study Concludes Wage Paid Parental Leave Job Posting Sites

The Irs Volunteer Income Tax Assistance Vita And The Tax Counseling For The Elderly Tce Programs Prepare Tax Returns Tax Return Tax Preparation Income Tax

Everything In The House Democrats Budget Bill The New York Times

What Is The Difference Between Refundable And Nonrefundable Credits Tax Policy Center

Named In The Will What To Know About Canadian Inheritance Tax Laws 2022 Turbotax Canada Tips